Retirement Accounts and Deferred Annuities in Medicaid Crisis Planning

When clients seek help from an attorney to qualify for Medicaid benefits, they are often relying on IRAs and annuities to cover their post-retirement expenses. While these investments are valuable for generating income during retirement, they can create complications when it comes to Medicaid qualification. In many cases, clients face a crisis because they cannot afford the high cost of a nursing home stay for long, and these assets may lead to disqualification from Medicaid.

How Do Retirement Accounts and Deferred Annuities Impact Medicaid?

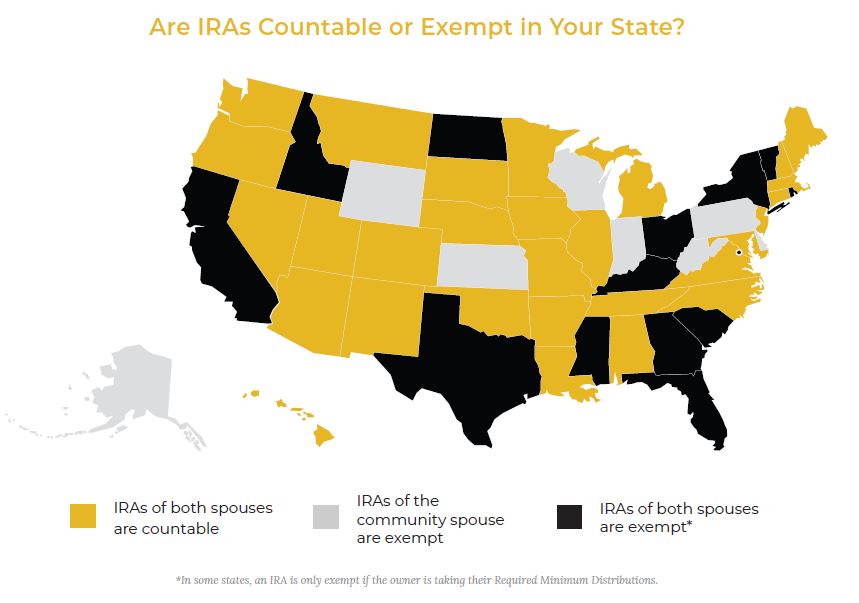

Retirement accounts and deferred annuities can trigger disqualification from both an income and asset standpoint. Income generated by Required Minimum Distributions (RMDs) and fixed or variable annuity payments increases the client’s income, which will be factored into their Medicaid co-pay. Depending on the state’s Medicaid rules, an IRA may be considered a countable asset for the institutionalized individual, the community spouse, or both. Additionally, the cash value of a deferred annuity is treated as an asset in most states.

Although retirement accounts and deferred annuities are excellent financial tools due to their tax-free growth, liquidating them during Medicaid planning can create a significant tax liability, the very issue they were designed to avoid. This creates a conflict between the asset’s intended purpose and its impact on Medicaid qualification.

Read More: How to Protect Clients’ Assets Through Medicaid Planning

How to Preserve These Funds during Crisis Planning

Fortunately, there are solutions available to accelerate Medicaid eligibility while safeguarding these accounts and, in some cases, preserving the tax benefits. A Medicaid Compliant Annuity can be an effective strategy to convert an IRA without incurring penalties or to transfer the value of a deferred annuity.

Jim is responsible for creating, curating, and promoting high-quality content related to the estate planning and elder law industry. He also plays a primary role in designing and maintaining a robust education and content calendar for Attorney Access.